Step By Step Guide to Selling Your House + Free PDF

Estimated reading time 10 minutes

Selling your house can be a daunting task, but with the right approach and guidance, it can be a smooth and successful process. Whether you're a first-time seller or have sold property before, having a clear plan can make all the difference. In this step-by-step guide, we'll walk you through the essential stages of selling your house, from instructing a solicitor to completion.

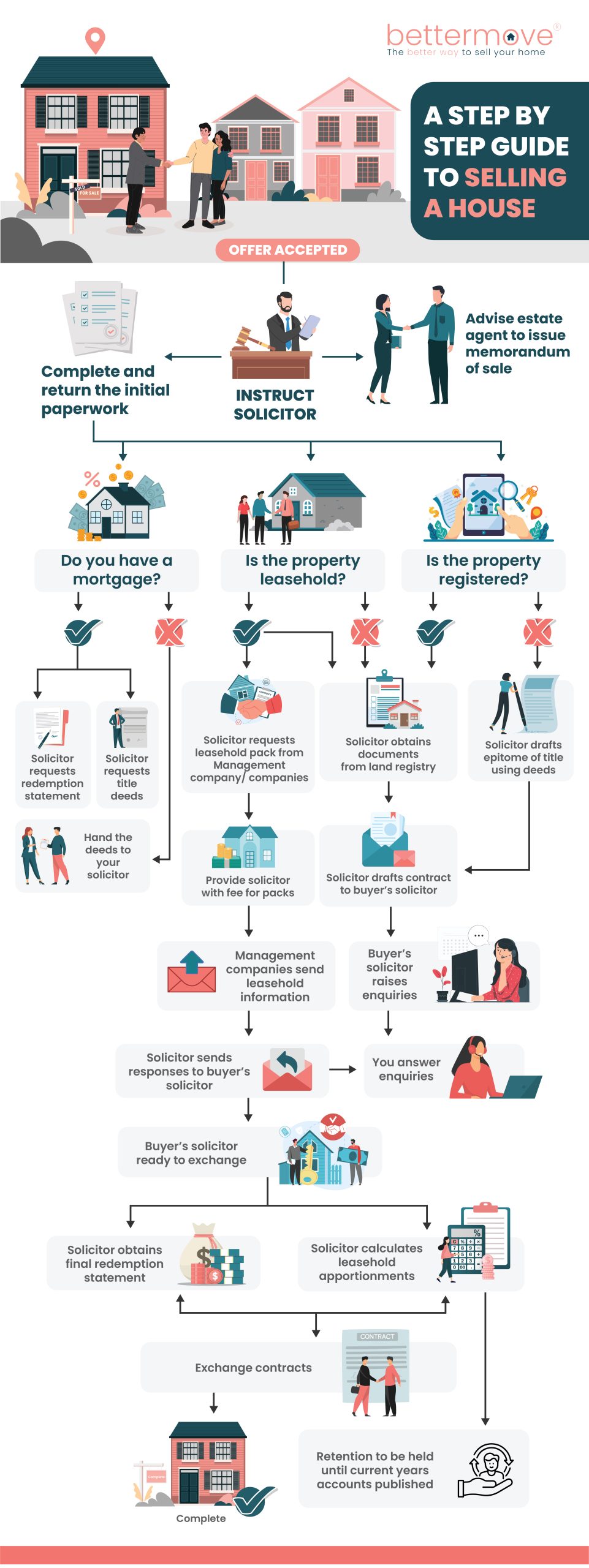

We have put together a step-by-step infographic, streamlining the process for you based on factors such as finances and property type. Below, you will be able to select the type of purchase you’re proceeding with, with full detail provided on the process.

Guide to selling a house: starting points

Fortunately, the process begins the same regardless of property status, type, and your financial situation.

After you have accepted an offer from a buyer, it’s time to begin the selling process. Once you have instructed a solicitor, they will:

- Advise the estate agent to issue a memorandum of sale

- Help with the completion of initial paperwork

Following this, the process will differ depending on whether your property is:

- Registered or unregistered

- Freehold or leasehold

- Being sold with or without a mortgage

Click below to navigate to your selling scenario:

- Selling a registered freehold property with a mortgage

- Selling a registered freehold property without a mortgage

- Selling a registered leasehold property with a mortgage

- Selling a registered leasehold property without a mortgage

- Selling an unregistered freehold property with a mortgage

- Selling an unregistered freehold property without a mortgage

- Selling an unregistered leasehold property with a mortgage

- Selling an unregistered leasehold property without a mortgage

Selling a registered freehold property with a mortgage

After the initial steps your solicitor will:

- Request a mortgage redemption statement from your lender

- Request property title deeds from the Land Registry

Your solicitor will then draft the contract for the buyer’s solicitor.

The buyer’s solicitor will raise enquiries which will be answered by your solicitor. You may be asked for input where appropriate.

Following this back and forth the buyer’s solicitor will be in a position to exchange.

Your solicitor will then obtain the final redemption statement from your lender.

Contracts will then be exchanged.

The sale can complete.

Selling a registered freehold property without a mortgage

Your solicitor will need the title deeds for the property, these can be obtained from the Land Registry. Your solicitor should request these themselves unless you already have a copy.

To progress the sale your solicitor will draft the contract and send it to the buyer’s solicitor.

There will then be back and forth between your solicitor and the buyer’s solicitor. Your buyer’s solicitor may have questions, which will be answered by your solicitor. They may require your help at times.

Once the questions from the buyer’s solicitor have been answered you’re in a position to exchange.

Contracts will then be exchanged.

The sale can complete.

Selling a registered leasehold property with a mortgage

After the initial steps your solicitor will:

- Request a mortgage redemption statement from your lender

- Request property title deeds from the Land Registry

In regard to the leasehold of your property, your solicitor will also request a leasehold pack from the management company/companies. You my need to pay a fee for this to your solicitor as some leasehold companies charge for this. Once paid, the leasehold information will be sent across.

Your solicitor will then draft the contract for the buyer’s solicitor.

The buyer’s solicitor will raise enquiries which will be answered by your solicitor. You may be asked for input where appropriate.

Following this back and forth the buyer’s solicitor will be in a position to exchange.

Your solicitor will then obtain the final redemption statement from your lender.

Contracts will then be exchanged.

The sale can complete.

Selling a registered leasehold property without a mortgage

After the initial steps your solicitor will request property title deeds from the Land Registry.

Your solicitor will also obtain the leasehold pack from the management company/companies. Some companies charge for this leasehold information to be sent across, so don’t be surprised if your solicitor requests for this fee to be paid. Once complete, the leasehold pack will be sent to your solicitor.

Your solicitor will then draft the contract for the buyer’s solicitor.

The buyer’s solicitor will raise enquiries which will be answered by your solicitor. You may be asked for input where appropriate.

Following this back and forth the buyer’s solicitor will be in a position to exchange.

Contracts will then be exchanged.

The sale can complete.

Selling an unregistered freehold property with a mortgage

After the initial steps your solicitor will:

- Request a mortgage redemption statement from your lender

- Draft epitome of title using deeds as your property is unregistered

Your solicitor will then draft the contract for the buyer’s solicitor.

The buyer’s solicitor will raise enquiries which will be answered by your solicitor. You may be asked for input where appropriate.

Following this back and forth the buyer’s solicitor will be in a position to exchange.

Your solicitor will then obtain the final redemption statement from your lender.

Contracts will then be exchanged.

The sale can complete.

Selling an unregistered freehold property without a mortgage

As your property is not registered, your solicitor will draft epitome of title using deeds.

To progress the sale your solicitor will then draft the contract and send it to the buyer’s solicitor.

There will then be back and forth between your solicitor and the buyer’s solicitor. Your buyer’s solicitor may have questions, which will be answered by your solicitor. They may require your help at times.

Once the questions from the buyer’s solicitor have been answered you’re in a position to exchange.

Contracts will then be exchanged.

The sale can complete.

Selling an unregistered leasehold property with a mortgage

After the initial steps your solicitor will:

- Request a mortgage redemption statement from your lender

- Draft epitome of title using deeds as your property is unregistered

In regard to the leasehold of your property, your solicitor will also request a leasehold pack from the management company/companies. You may need to pay a fee for this to your solicitor as some leasehold companies charge for this. Once paid, the leasehold information will be sent across.

Your solicitor will then draft the contract for the buyer’s solicitor.

The buyer’s solicitor will raise enquiries which will be answered by your solicitor. You may be asked for input where appropriate.

Following this back and forth the buyer’s solicitor will be in a position to exchange.

Your solicitor will then obtain the final redemption statement from your lender.

Contracts will then be exchanged.

The sale can complete.

Selling an unregistered leasehold property without a mortgage

To start, your solicitor will draft epitome of title using deeds. This is because your property is not registered.

Your solicitor will also obtain the leasehold pack from the management company/companies. Some companies charge for this leasehold information to be sent across, so don’t be surprised if your solicitor requests for this fee to be paid. Once complete,t he leasehold pack will be sent to your solicitor.

Your solicitor will then draft the contract for the buyer’s solicitor.

The buyer’s solicitor will raise enquiries which will be answered by your solicitor. You may be asked for input where appropriate.

Following this back and forth the buyer’s solicitor will be in a position to exchange.

Contracts will then be exchanged.

The sale can complete.

What happens after you sell your property?

Following completion, your solicitor will ensure that the transfer of ownership is registered with the Land Registry, officially updating the property's ownership records. You'll need to vacate the property and hand over the keys to the new owner.

After selling your property, you may need to cancel utilities, notify your insurance company, and update your address with relevant parties. Keep copies of all closing documents for your records.

Finally, take a moment to celebrate the successful sale of your property and begin your next chapter, whether it involves purchasing a new home, downsizing, or exploring other opportunities.

Step by step guide to selling your house PDF

Your free PDF is below, simply follow the arrows and prompts to discover your journey to buying. You can also download our Step By Step Guide to Selling Your House.