Your Ultimate Guide to Buying a House + Free PDF

Estimated reading time 8 minutes

Buying a house is ranked as one of the most stressful life events for UK citizens. So much so that is placed above having a child, starting a new job, and even going through a divorce. Whether you’re a first-time buyer, or a seasoned mover, the process can seem extremely daunting.

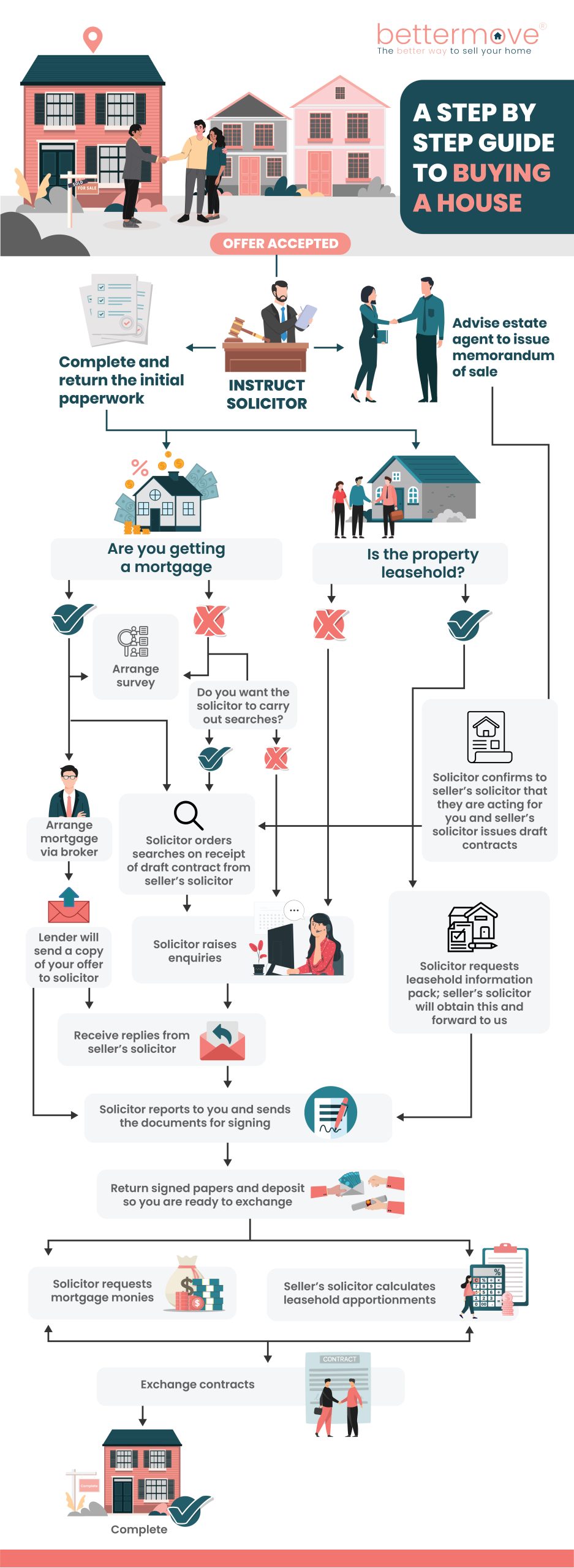

If you’re on the horizon of buying a house Bettermove is here to help. We have put together a step-by-step infographic, streamlining the process for you based on factors such as finances and property type. Below, you will be able to select the type of purchase you’re proceeding with, with full detail provided on the process.

Step by step guide to buying a house

Fortunately, the process begins the same regardless of finances and property type.

Once you have had an offer accepted, it’s time to get the ball rolling. The first port of call will be to instruct a solicitor. Simultaneously they will:

- Advise the estate agent to issue a memorandum of sale

- Help with the completion of initial paperwork

Following this, the process will differ depending on whether the property you’re buying is:

- Freehold or leasehold

- Being bought with a mortgage or cash

Click below to navigate to your buying scenario.

- I am buying a freehold property with a mortgage

- I am buying a leasehold property with a mortgage

- I am buying a freehold property with cash

- I am buying a leasehold property with cash

I am buying a freehold property with a mortgage

Following the initial completion of paperwork and memorandum of sale facilitated by your solicitor, you will need to arrange a survey.

At the same time you will need to finalise your mortgage via your lender. Your lender will then send a copy of your mortgage to your solicitor.

Your solicitor will order searches to be completed on receipt of the draft contracts from the seller’s solicitor. Acting on your behalf, your solicitor will raise enquiries, and act accordingly based on the replies from the seller’s solicitor.

Your solicitor will report back to you and send you documents that require signing. You will need to return this signed paperwork to your solicitor, as well as sending across your deposit. They will handle your deposit for you. This puts you in a position to exchange.

Your solicitor will then request the mortgage monies from your lender.

Once completed, you will be able to exchange contracts.

You can then complete on the sale. You will be given a completion date for this.

I am buying a leasehold property with a mortgage

After the general first steps for any sale are completed you will need to arrange a survey.

At the same time, your solicitor will confirm to the seller’s solicitor that they are acting for you regarding the leasehold property. The seller’s solicitor will issue draft contracts and provide your solicitor with a leasehold information pack.

Your solicitor will order searches on receipt of the draft contracts from the seller’s solicitor. Your solicitor will raise enquiries as appropriate.

During the steps above that your solicitor is carrying out, you will need to finalise your mortgage with your lender. Your lender will then send a copy of your offer to your solicitor.

Your solicitor will report back to you regarding their searches and correspondence from the seller’s solicitor. They will give you some documents to sign.

You will need to return these documents, along with your deposit monies, to your solicitor. You are now set to exchange imminently.

Once everything is in order, your solicitor will request the mortgage monies from your lender. You can now exchange contracts.

Following exchange you will be given a completion date. When you complete the property is legally yours.

I am buying a freehold property with cash

Continue the purchase by arranging a survey.

Your solicitor will order searches to be completed on receipt of the draft contracts from seller’s solicitor. Acting on your behalf, your solicitor will raise enquiries, and act accordingly based on the replies from the seller’s solicitor.

Your solicitor will report back to you and send you documents that require signing. You will need to return this signed paperwork to your solicitor, as well as sending across your cash deposit. They will handle your deposit for you. This puts you in a position to exchange.

Your solicitor will then request the outstanding money to be sent across.

Once completed, you will be able to exchange contracts.

You can then complete on the sale. You will be given a completion date for this.

I am buying a leasehold property with cash

After the general first steps for any sale are completed you will need to arrange a survey.

At the same time, your solicitor will confirm to the seller’s solicitor that they are acting for you regarding the leasehold property. The seller’s solicitor will issue draft contracts and provide your solicitor with a leasehold information pack.

Your solicitor will order searches on receipt of the draft contracts from seller’s solicitor. Your solicitor will raise enquiries as appropriate.

Your solicitor will report back to you regarding their searches and correspondence from the seller’s solicitor. They will give you some documents to sign.

You will need to return these documents, along with your cash deposit, to your solicitor. You are now set to exchange imminently.

Once everything is in order, your solicitor will request the outstanding monies from you. You can now exchange contracts.

Following exchange you will be given a completion date. When you complete the property is in your possession.

What happens after you complete on buying a property?

Completion means that you own the property. Everything is legally in your name and you are free to move into your new home. There are some steps you will need to take following your possession. These can include:

- Arranging utilities and services

- As well as halting any at your previous address if required

- Securing homeowner insurance if not already complete

- Carry out any repairs or renovations

- Ensure your mortgage payments are in place

- Meet any tax obligations

Are you considering buying a new home? Don’t forget, Bettermove has a number of properties for sale that may meet your needs. Alternatively, if you want to sell your house for free to facilitate a future purchase, get in touch with the Bettermove team today.

Step by step guide to buying a house PDF

Your free PDF is below, simply follow the arrows and prompts to discover your journey to buying. You can also download our Step By Step Guide to Buying a House.